INVESTMENT INCENTIVE

All companies in MINH HUNG SIKICO Industrial Park enjoy the tax incentives.

CORPORATE INCOME TAX

0 %in 2 years from the year payable tax amounts arise.

8.5%tax reduction for the next 4 years

17%In 10 years from the year when the first revenue it generated.

25% discount on deposit

case of IMPORT tax exemption:

Tax exemption for imported commodities in order to create fixed assets for investors who qualify for these investment incentives:

- Machinery, equipment; raw materials and supplies used for manufacturing machinery or equipment or manufacturing components, parts, detachable parts, spare parts of machinery and equipment.

- Specialized means of transport in the technological lines directly used for the project's production activities.

- Construction supplies not available domestically.

Import tax exemption for the first 05 years starting from the first day of manufacturing:

- Import tax materials and components that can not be domestically manufactured for the investment Project's production activities that are in the list of industries and sectors eligible for special investment incentives in accordance with the legal regulations on investment.

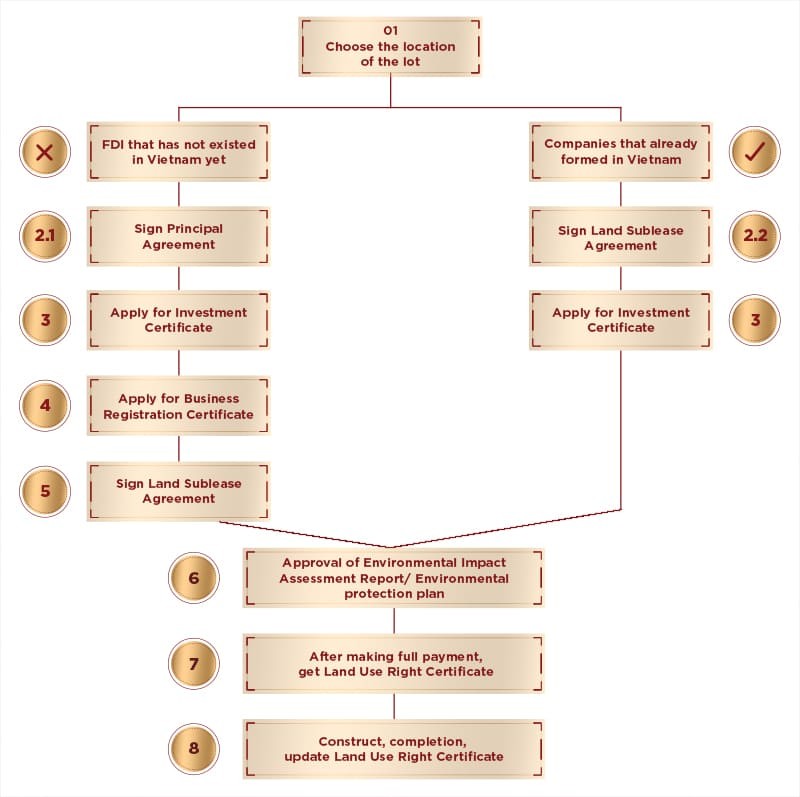

INVESTMENT PROCESS